What “Local 3PL Fulfillment” Actually Means (and What It Does Not)

If you’re researching local 3PL fulfillment, you’re probably feeling pressure from one of three places: delivery expectations, cost volatility, or the sense that your operation is getting harder to control. In conversations like this, I usually start by aligning on definitions—because “local fulfillment” gets used as a shortcut for several different problems.

In simple terms, local fulfillment services mean your inventory sits inside the same market where orders are delivered, and a 3PL runs the pick/pack/dispatch workflow domestically. What it does not automatically do is fix upstream decisions—forecasting, replenishment discipline, SKU complexity, or the ability to scale down when demand softens. If you want a broader decision lens before going deeper, start with our pillar on choosing a 3PL partner.

From the Huixin side, we treat local fulfillment as a system design choice, not a “graduation step.” If you’re currently shipping cross-border and thinking “local warehouse = stability,” it’s worth checking whether your instability comes from distance—or from inventory decisions that will follow your stock wherever it goes.

Why “Going Local” Is Often Suggested Too Early

If you’re in seller communities, you’ll hear the same pattern: “move inventory closer,” “customers want faster delivery,” “domestic shipping is cheaper.” That advice can be directionally true, but it’s often missing the part that matters most—what costs and constraints you introduce the moment you commit to a local warehouse.

Here’s what tends to happen in the real world: as soon as you move inventory into a domestic facility, you add a layer of fixed cost and rigidity. If demand dips, you don’t “dip with it” as easily. If your catalog expands, forecasting errors multiply across SKUs. If you split inventory across nodes, stockouts and imbalances become more frequent unless you have strong replenishment logic.

This is why Huixin generally frames local 3PL fulfillment as an optimization tool that works best when your operation is already behaving predictably. If you’re still in a phase where you’re learning demand signals, you’ll often get better results by improving the parts of the system that drive variability first. For practical operational thinking like this, you can also browse our 3PL logistics insights.

When You Actually Need a Local 3PL (Decision Triggers)

If you’re asking, “Do I need a local 3PL now?” I’d avoid using revenue or brand stage as your answer. The more reliable approach is to look for decision triggers—signals that local fulfillment will remove a structural constraint rather than create a new one.

In practice, local 3PL fulfillment starts to make sense when order volume is stable outside of promotional spikes, when delivery speed is clearly affecting conversion or retention, and when your cost structure shows cross-border last-mile (or repeated split shipments) becoming the dominant drag on margin. It can also be a risk decision—when a single overseas node creates unacceptable exposure, or when policy uncertainty makes resilience more valuable than pure cost-minimization.

Notice what’s not in those triggers: “everyone is doing it” or “it feels like the next step.” If your reason is primarily emotional pressure—complaints, comparison, anxiety—local fulfillment often turns into a costly attempt to buy certainty. If you want to sanity-check what costs you’re actually trading off, pair this section with our breakdown of 3PL logistics cost.

When a Local 3PL Is the Wrong Move

The fastest way to regret a local warehouse is to move inventory locally before your demand behavior is stable enough to justify it.

If you’re still testing products, channels, or pricing, local warehousing tends to reduce flexibility at exactly the moment you need it most. If your catalog is high-SKU and low-velocity, domestic storage doesn’t make slow-moving inventory sell faster—it simply makes it more expensive to hold and harder to unwind. And if your operation relies on reactive replenishment rather than disciplined planning, local fulfillment can magnify mistakes rather than contain them.

This is where Huixin’s approach is usually conservative: if you’re currently in a volatility-heavy phase, we’ll often recommend a structure that keeps optionality upstream while improving service levels through workflow design and shipping-line choices, instead of locking inventory into a fixed domestic footprint too early.

How to Evaluate Local 3PL Fulfillment Services (Beyond Location)

When sellers compare local fulfillment services, the first filter is usually geography: “Where is the warehouse?” In reality, two warehouses in the same city can perform very differently depending on cutoff rules, carrier integration, exception handling, peak-season behavior, and how transparently they price storage and handling.

If you’re evaluating providers, focus less on “distance to customer” and more on “fit to your order reality.” Your order profile—order variability, SKU handling constraints, returns behavior, and seasonal spikes—will determine whether a warehouse runs smoothly or becomes a constant source of exceptions.

If you want a broader market view (without treating it as a shopping list), you can reference our directory-style overview of leading 3PL providers and then come back here to apply the evaluation lens to your short list.

Local vs Regional vs Hybrid Fulfillment Models

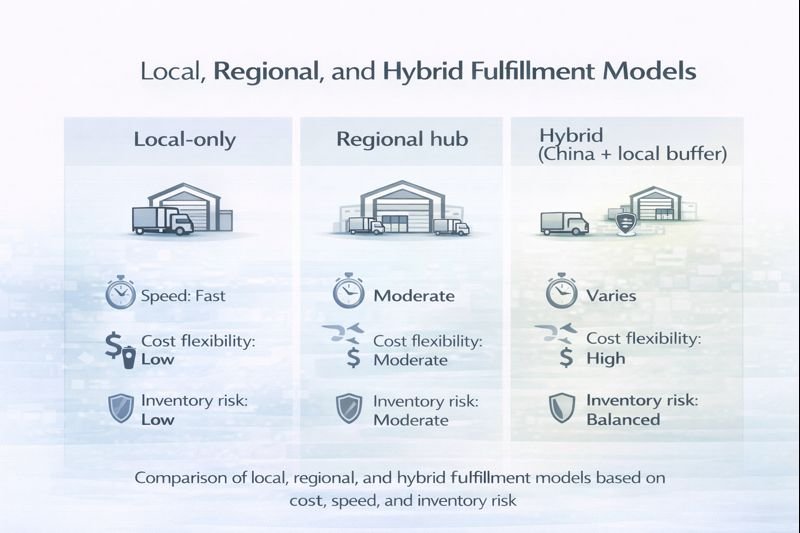

Local fulfillment is only one model. In many cases, regional hubs or hybrid designs provide a better balance between speed, cost flexibility, and inventory risk—especially if you sell across multiple markets or your demand signal is still evolving.

If you’re currently thinking in binary terms (“either cross-border or local”), it may help to reframe the decision as network design. The right answer is often a staged approach: keep inventory centralized where it’s easier to control, then add local buffers only where service-level requirements justify the cost.

This is also where a China-based partner can help you avoid overcommitting. If you’re currently weighing local warehousing but want to preserve flexibility, Huixin’s typical approach is to design a system that improves delivery outcomes while keeping inventory decisions controllable—then expand locally only when the data supports it.

How This Fits into Your Overall 3PL Strategy

A local 3PL can improve delivery speed and reduce certain shipping frictions. But it won’t fix weak inventory planning, unstable demand, or unclear replenishment rules. The more useful question isn’t “Do I need a local warehouse?” It’s “What constraint am I removing—and is local fulfillment the most efficient way to remove it right now?”

If you want the full decision context—including trade-offs between cost and control—read Choosing a 3PL Partner and then revisit this page when you’re ready to select a model. If you’re already close to a decision and want a second opinion, you can also reach us here: contact Huixin.

Decision Checklist (Use This Before You Commit)

Before you sign with a local 3PL fulfillment provider, try to answer these clearly:

If demand drops by 30%, does the model still hold? If SKUs double, do storage and handling rules remain manageable? Are you reducing cost structurally, or just shifting cost into domestic warehousing? And most importantly—are you solving a measured constraint, or reacting to pressure?

If you can answer those with confidence, local fulfillment may be the right next move. If not, it’s often safer (and cheaper) to redesign the system first, then localize selectively.

Related:

Local 3PL Fulfillment |

3PL Logistics Cost |

3PL Logistics Insights