Why “Leading 3PL Providers” Often Means Different Things

If you search for leading 3PL providers, you’ll see rankings, big-name logos, and “top lists.” The problem is that the word

“leading” usually blends several different strengths into one label—coverage, software, or price access—without telling you what that strength

costs you operationally.

In real fulfillment operations, those differences show up quickly. A provider can be “leading” in geographic reach yet slow to adapt. Another can

be “leading” in dashboards and integrations but still be one layer removed from physical execution. And some networks “lead” mainly by making it

easy to compare options—without being accountable for outcomes.

That’s why we don’t treat “leading” as a decision criterion at HUIXIN. We treat it as a starting point to ask a more useful question:

what 3PL model is this provider built on, and what trade-offs are structural?

The Main 3PL Provider Models Behind the “Leading” Label

Asset-Based Global 3PL Providers

Asset-based global providers became “leading” by building infrastructure over time—warehouses, transportation capacity, contracts, and standardized

processes. If you’re running stable, predictable flows, that standardization can be a real benefit because it produces consistency at scale.

The same standardization can also become friction when your business changes frequently: SKU churn, channel expansion, packaging updates, country-by-country

requirements, or constant process iteration. In those cases, you’re often trading flexibility for stability. That trade-off isn’t a service flaw; it’s how

the model stays consistent across many clients.

Platform-Based / Tech-Driven 3PL Providers

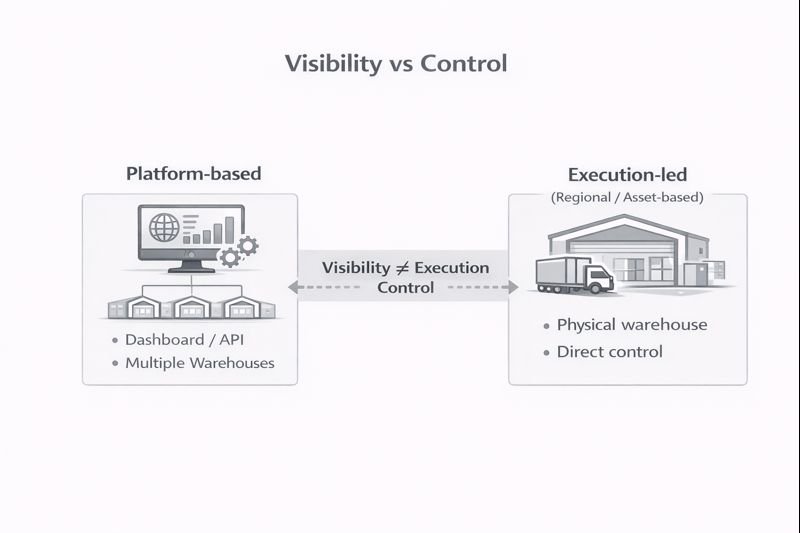

Platform-based providers usually “lead” through software: fast onboarding, integrations, and visibility across multiple fulfillment nodes. This can feel

ideal early on—especially if you’re expanding to new markets and want the operational picture in one place.

The trade-off becomes obvious when exceptions appear. If the platform coordinates execution but doesn’t physically execute it, responsibility can split between

the platform and the warehouse partner. That can slow down resolution and make accountability harder to enforce.

“Visibility vs Control” is where many seller expectations break: dashboards can improve visibility, but they don’t automatically increase execution control.

“Visibility vs Control” is where many seller expectations break: dashboards can improve visibility, but they don’t automatically increase execution control.

Regional / Localized 3PL Specialists

Regional specialists focus on one geography deeply—often China, Southeast Asia, or a single destination market. If you’re dealing with China-origin supply chains,

this model tends to be more fluent in the “messy reality” that doesn’t appear in demos: factory pickup variability, export documentation details, carton-level inconsistencies,

non-standard labeling, and frequent exception handling.

The trade-off is that not every regional provider scales indefinitely, and system maturity varies. This model works best when the scope is explicit and both sides agree on

how exceptions, changes, and growth will be managed.

If you are operating China-side fulfillment and want more execution clarity, HUIXIN deliberately operates here. We don’t try to be everything globally; we focus on making

China-side operations controllable and transparent in the places where problems typically originate. If you’re evaluating this model specifically, you may also want to read:

local 3PL fulfillment.

Marketplace-Style Fulfillment Networks

Marketplace-style networks “lead” by giving you lots of options and making comparison easy. This can be useful for testing or short-term projects.

But marketplaces are not a single operational owner—service quality can vary significantly by node, and accountability is often diffuse.

If you’re building a long-term fulfillment operation, this model can become a management burden because you end up coordinating multiple parties yourself.

What These 3PL Models Are Really Optimized For

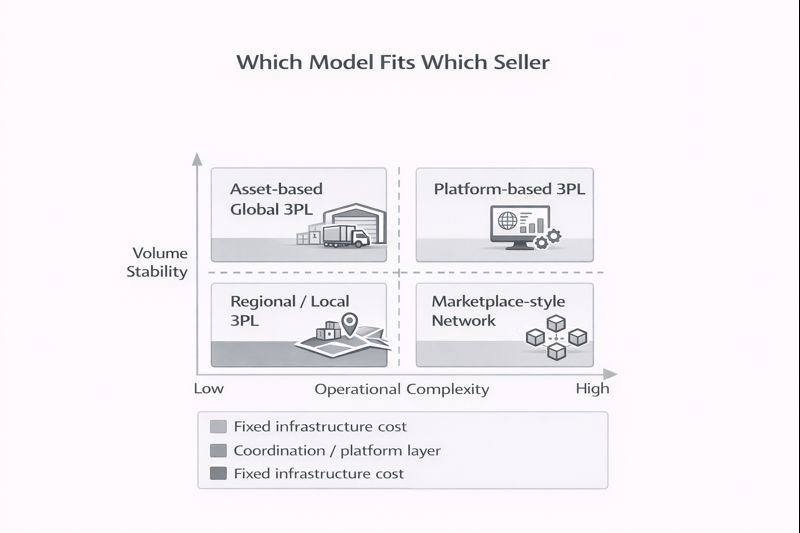

Each model solves one set of problems by accepting another. That’s not a criticism—it’s the point. In logistics, trade-offs don’t disappear; they shift.

Asset-based providers tend to prioritize standardization and consistency at scale. Platform-based models prioritize integration speed and operational visibility.

Localized specialists prioritize hands-on execution and flexibility in a specific geography. Marketplace networks prioritize optionality and price comparison.

If you take only one thing from this page, it should be this: don’t evaluate leading 3PL providers as a single category. Evaluate the

operating model, because that’s what determines how your day-to-day fulfillment will actually behave.

Why Cost Structure Differences Persist Across “Leading” Providers

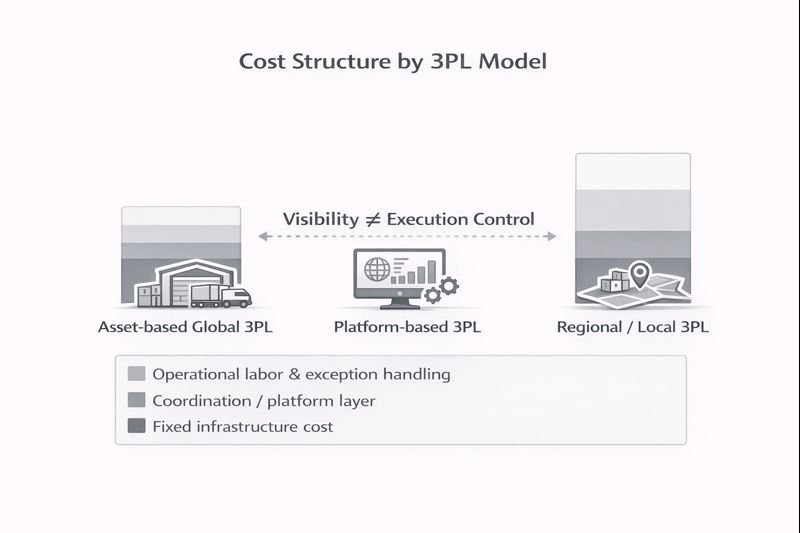

Sellers often assume pricing differences are mostly negotiable. In reality, a big part of 3PL pricing is structural—because different models spend money in different places.

Infrastructure-heavy providers carry fixed costs. Platform models have a coordination layer. Localized specialists often have lower fixed infrastructure costs but invest more labor

into operational involvement and exception handling.

This matters because it explains why quotes can look similar initially and then diverge over time as complexity appears. If you want a deeper breakdown of hidden cost drivers,

read: 3PL logistics cost.

Cost differences are often structural: different 3PL models allocate cost to infrastructure, platform layers, or labor in different proportions.

Cost differences are often structural: different 3PL models allocate cost to infrastructure, platform layers, or labor in different proportions.

Which 3PL Model Fits Which Seller

If you’re running stable, high-volume flows with minimal operational change, a global asset-based provider can be a good fit.

If you’re expanding fast and prioritizing integration speed and visibility, a platform-based model can work well—especially early.

If your fulfillment depends on China-side coordination, frequent edge cases, or factory variability, localized specialists tend to align better with day-to-day reality.

A practical way to decide is mapping your operation by complexity and volume, then choosing the model whose trade-offs you can tolerate.

A practical way to decide is mapping your operation by complexity and volume, then choosing the model whose trade-offs you can tolerate.

Common Mistakes When Choosing “Top” or “Leading 3PL Providers”

The most common mistake is using brand recognition as a proxy for fit. Another is treating a system demo as proof of execution capability. A third is comparing headline rates

while ignoring exception handling, change requests, and how fast problems are resolved when reality diverges from plan.

If you’re seeing recurring issues like slow responses, unclear ownership, cost drift, or “that’s not covered” conversations after onboarding, it’s often a sign that the

model you chose doesn’t match the operational reality you’re running.

How to Evaluate Beyond Rankings

A more useful evaluation starts with operational questions: Who controls daily execution? Who owns exceptions? Where does pricing flexibility end? How visible—and actionable—

are issues when they occur? These questions cut through rankings because they map to how fulfillment behaves under pressure.

If you want a broader decision framework rather than a model explanation, you can return to the main page here:

leading 3PL providers

(this page), and for deeper operational patterns and failure modes, see:

3PL logistics insights.

Final Takeaway

If you’re searching for leading 3PL providers, you’re usually searching for certainty. Real certainty comes from understanding trade-offs and choosing the

model that matches your constraints—volume, complexity, risk tolerance, and how much control you need over execution.

If you’re operating China-based fulfillment and want execution clarity instead of marketing narratives, that’s where HUIXIN is designed to help. If you’re at the stage of

comparing options or diagnosing a failing setup, you can reach us here:

contact us.