Introduction

Why Most 3PL Decisions Fail After the Contract Is Signed

Choosing a third party logistics (3PL) partner often looks like a straightforward procurement task: compare quotes, review service lists, check warehouse locations, and sign a contract. On paper, many 3PL providers appear similar. In practice, this is where most long-term problems begin.

The reason is simple but frequently overlooked:

a 3PL logistics relationship is not a short-term service purchase. It is an ongoing outsourcing of operational execution, decision-making processes, and a meaningful degree of control over your supply chain. When companies approach 3PL selection as a vendor comparison exercise rather than a structural operating decision, misalignment tends to surface only after the contract is already in force.

From our perspective as a logistics service provider working with growing cross-border sellers and supply-chain teams—including at Huixin, where we see both successful and failed 3PL transitions—the same pattern repeats. Initial expectations are shaped by pricing tables and capability checklists, while the real challenges emerge months later: cost volatility, limited visibility, slow exception handling, and growing dependency on systems or processes that are hard to unwind.

One reason these failures are so common is that the 3PL logistics market is far from uniform. Different providers operate under fundamentally different models—some prioritize scale, others flexibility; some rely heavily on standardized processes, others on manual intervention. These differences are rarely obvious during early sales conversations, yet they have a direct impact on cost behavior, risk exposure, and operational control. Understanding these trade-offs is essential before evaluating any specific provider.

Another challenge is that many 3PL risks only become visible through use. Issues around inventory accuracy, data transparency, billing logic, or exception handling are difficult to assess in advance. Experienced sellers often describe a learning curve that only begins once real order volume, peak seasons, or abnormal scenarios are introduced into the system.

There is also a widespread assumption that working with a local 3PL fulfillment service is always the safer or more efficient choice. In reality, proximity alone does not guarantee better outcomes. For some business models, a local 3PL adds unnecessary complexity or cost, while for others it is critical. Knowing the difference matters more than simply choosing what feels convenient.

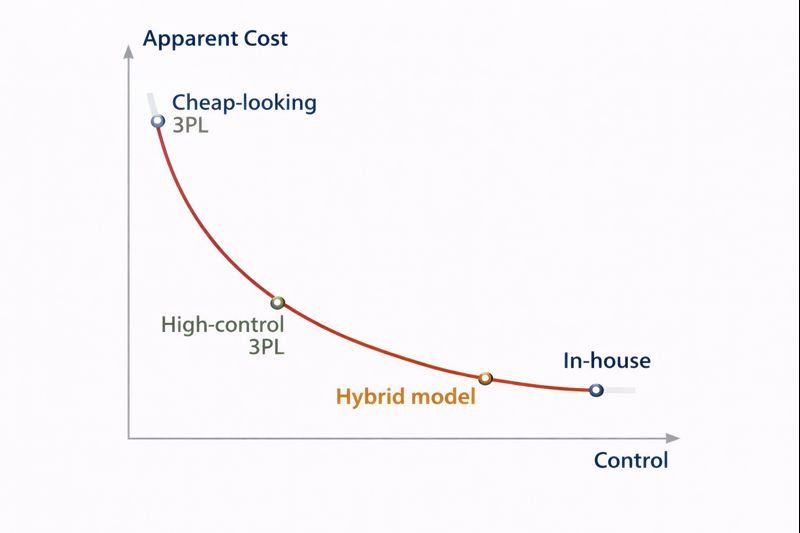

Finally, cost itself is frequently misunderstood. The question is rarely whether 3PL services are “cheap” or “expensive.” More often, it is about how much operational control is being traded away in exchange for apparent savings. When cost discussions are disconnected from control, predictability, and risk ownership, decisions tend to optimize for the short term while creating long-term constraints.

This article is written to reframe how 3PL partner selection should be approached. Rather than focusing on provider lists or feature comparisons, it breaks the decision down into costs, risks, and a practical evaluation framework—so that choosing a 3PL becomes a deliberate operating decision, not a reactive one.

Step Zero: Be Clear About What You Are Actually Outsourcing

Before comparing prices, warehouse locations, or promised service levels, there is a more fundamental question most companies skip: what exactly are you outsourcing when you work with a 3PL logistics provider?

This step matters because many failed 3PL logistics relationships do not break down at the execution level. They fail earlier—at the expectation level. When the scope of outsourcing is poorly defined, even a capable third party logistics provider can appear to underperform.

This section exists as a decision-calibration layer. If this part is unclear, no pricing model or provider comparison later in the process will compensate for it.

3PL Is Not a Service — It’s an Operating Model

A common misconception is that companies “buy 3PL services” in the same way they buy transportation or packaging. In reality, 3PL logistics is not a single service—it is an operating model.

When you engage a 3PL logistics provider, you are not just outsourcing execution. You are outsourcing three core elements of daily operations:

People

You are replacing internal operators with an external workforce. Their training standards, incentive structures, and error-handling behavior directly affect your fulfillment quality, even though they are not on your payroll.

Processes

You are adopting the provider’s standard operating procedures—how inbound is handled, how inventory is counted, how exceptions are escalated. Even “customized” workflows usually sit on top of a fixed process backbone.

System-level judgment

Beyond physical handling, you are also delegating decisions to the provider’s systems and rules: how inventory is allocated, how priorities are set during peak periods, and how discrepancies are recorded or resolved. This is often the least visible, but most impactful, form of outsourcing.

From our experience at HUIXIN, many clients only realize this after onboarding is complete. At that point, discussions shift from “service quality” to much harder questions about visibility, control, and decision authority—topics that are difficult to renegotiate once operations are live.

When a 3PL Makes Sense — and When It Is a Structural Mistake

A 3PL logistics model can be a powerful lever, but only under the right conditions. Used incorrectly, it does not reduce complexity—it displaces it.

When a 3PL acts as leverage

A 3PL tends to work well when:

- Order volumes fluctuate and internal capacity would be inefficient to scale

- Fulfillment is operationally important but not a strategic differentiator

- The business values speed of execution over bespoke process control

- Data transparency and exception handling requirements are clearly defined upfront

In these cases, outsourcing execution allows internal teams to focus on planning, sourcing, and customer-facing decisions while the third party logistics provider absorbs operational variability.

When a 3PL becomes a structural mistake

Problems arise when:

- The business relies on highly customized workflows or frequent exceptions

- Inventory accuracy and real-time visibility are mission-critical

- Decision latency (waiting on the 3PL to act or respond) creates downstream risk

- The cost of coordination outweighs the cost of execution itself

In such scenarios, working with a 3PL logistics provider may simply externalize complexity without reducing it. The organization loses control but does not gain meaningful efficiency.

This is also where assumptions about local 3PL logistics providers often break down. Proximity alone does not solve structural misalignment. Without clarity on what should—and should not—be outsourced, even a nearby warehouse can become a bottleneck rather than a solution.

Step Zero is intentionally placed before any discussion of costs or provider comparisons. If you are not clear about which decisions you are willing to hand over and which ones must remain internal, evaluating 3PL logistics services becomes guesswork rather than strategy.

Pillar 1: Understanding the Real Cost Structure of 3PL logistics

Cost Is Not Price — It Is Long-Term Predictability

When companies evaluate 3PL logistics options, cost is usually the first—and sometimes only—filter. Quotes are compared line by line, and decisions are made based on which provider appears more “competitive.” The problem is that 3PL cost is rarely about the quoted number. It is about how predictable that number remains once real operations begin.

In practice, the most expensive third party logistics (3PL) relationships are often not the ones with the highest initial pricing, but the ones where costs fluctuate unpredictably as volume, complexity, or exceptions increase.

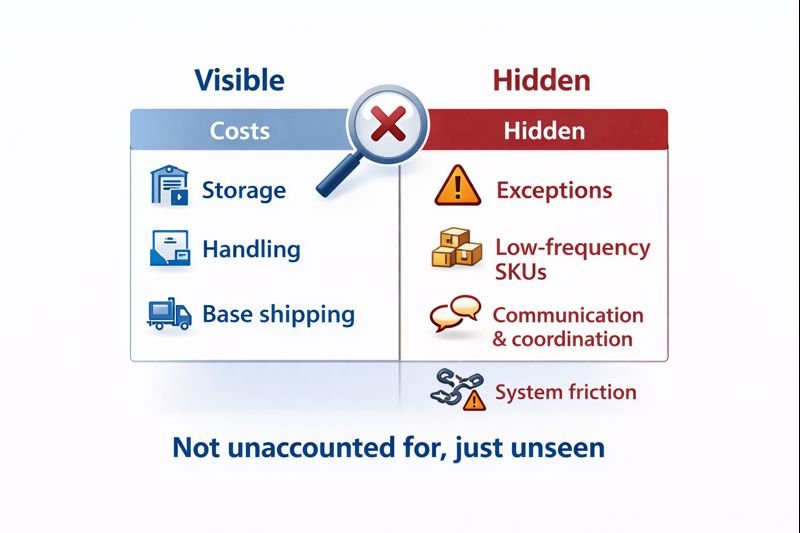

What 3PL Pricing Usually Shows You

Most 3PL logistics pricing structures focus on three visible components. These are the numbers that appear clearly in proposals and rate cards.

Storage

Charges based on pallet positions, bin locations, or cubic meters. These fees look stable and easy to forecast, which makes them comforting—but they represent only a small portion of total operational cost.

Handling and operations

Inbound receiving, pick-and-pack, labeling, and outbound processing fees. These are often standardized and appear transparent, but they assume “normal” order profiles and predictable workflows.

Basic transportation

Line-haul or last-mile shipping rates, usually benchmarked against market averages. These are often treated as pass-through costs and rarely raise concerns during evaluation.

Individually, these elements make a 3PL logistics provider look easy to budget for. Collectively, they create the illusion that total cost is well understood.

What 3PL Pricing Rarely Shows You

The largest cost drivers in 3PL logistics services tend to sit outside the visible rate card. They emerge only once operations scale or deviate from the ideal scenario assumed in the quote.

Exceptions and non-standard handling

Returns, address corrections, damaged goods, inventory discrepancies, and urgent rework are usually billed separately—or absorbed through slower response times. Either way, they carry cost.

Low-frequency or slow-moving SKUs

SKUs with irregular movement distort labor planning, space utilization, and picking efficiency. These inefficiencies are rarely reflected in headline pricing but accumulate steadily over time.

Human coordination cost

Emails, calls, escalations, manual reconciliations, and internal follow-ups consume time on both sides. While these costs do not always appear on invoices, they directly impact team productivity and decision speed.

System friction

Limited WMS visibility, delayed reporting, or rigid workflows create operational drag. When data cannot be accessed or trusted in real time, teams compensate with manual checks—another hidden cost.

From our experience at HUIXIN, these “invisible” costs are where most budget overruns originate. On paper, the pricing remains unchanged; in reality, the cost of managing the relationship keeps rising.

This is also where the cost-versus-control trade-off becomes clear. When pricing looks unusually simple or low, it often means that control over exceptions, prioritization, or data access has quietly shifted away from the client.

For a deeper cost-versus-control analysis across operating models, see:

Is 3PL logistics Worth the Cost? A Practical Cost vs Control Analysis.

Why “Cheaper” 3PL logistics Often Creates Higher Total Cost

Lower-priced 3PL logistics providers are not necessarily inefficient. However, their pricing models often rely on cost transfer mechanisms that only become visible over time.

Cost transfer through rigidity

Standardized processes reduce the provider’s internal cost but push adaptation effort onto the client. Every deviation becomes slower, more expensive, or both.

Cost transfer through volume assumptions

Low pricing frequently assumes stable order profiles and predictable throughput. When reality diverges—seasonality, promotions, or growth—the cost structure strains quickly.

Risk outsourcing without ownership

In some models, risk is technically outsourced but not actively managed. Inventory discrepancies, service delays, or billing disputes are treated as “exceptions” rather than systemic issues, leaving the client to absorb the impact.

In these cases, the failure is not operational incompetence. It is a misalignment between pricing logic and business reality. What looked like a cost-saving decision becomes a long-term efficiency drain.

Understanding the real cost structure of 3PL logistics is less about identifying the lowest number and more about assessing how costs behave under pressure. Predictability, transparency, and control determine whether a 3PL relationship remains sustainable as conditions change.

This is why cost analysis cannot be separated from control analysis—a topic explored further when evaluating whether 3PL logistics is truly worth the cost in different operating models.

Pillar 2: The Hidden Risks Most Companies Underestimate

In 3PL logistics, risk is often misunderstood. It is not defined by how often something goes wrong, but by how much of the operation you can actively manage when it does. Many risks remain invisible during evaluation because they do not appear in pricing tables or service descriptions. They surface only when the client needs to intervene and discovers that visibility or control is limited.

In practical terms, risk equals the portion of the operation that becomes reactive rather than manageable.

Operational Risk Is Rarely About Mistakes

Most companies worry about errors: wrong picks, delayed shipments, or inventory discrepancies. In reality, occasional mistakes exist in every logistics operation. What differentiates a manageable 3PL logistics provider from a risky one is not error frequency, but how clearly the operation exposes its logic when exceptions occur.

Two factors matter more than raw execution quality.

SOP transparency

When operating procedures are opaque, clients cannot understand why outcomes differ from expectations. Even if performance metrics appear acceptable, the inability to trace decisions back to defined processes makes continuous improvement difficult.

Exception traceability

In many third party logistics environments, exceptions are handled manually and resolved locally, without structured feedback loops. Over time, this creates recurring issues that are treated as isolated incidents rather than systemic signals.

From what we see at HUIXIN, operational risk escalates not when errors increase, but when clients lose the ability to ask precise questions and receive actionable answers.

Data and Visibility Risk

Visibility is often assumed to be solved by technology. As long as a 3PL logistics partner offers a WMS and regular reports, the operation is considered “under control.” This assumption is one of the most common sources of hidden risk.

A WMS does not equal controllability. Systems are only as useful as the decisions they support. If inventory data is delayed, aggregated, or difficult to reconcile with financial records, it limits the client’s ability to act proactively.

Similarly, reports are not the same as decision-grade data. Many reports describe what happened, not why it happened or what should be done next. When metrics are retrospective rather than diagnostic, operational management becomes reactive.

Over time, teams compensate by building parallel tracking processes, spreadsheets, or manual checks—quietly increasing internal workload while reducing trust in the system.

Dependency Risk: When a 3PL Becomes Hard to Replace

One of the least discussed risks in 3PL logistics is dependency. Most companies assume that switching providers is inconvenient but feasible. In reality, switching becomes harder the longer the relationship lasts.

The true switching cost is not limited to physical relocation or contract termination. It includes:

- Process knowledge embedded in the provider’s team

- Historical data stored in proprietary systems

- Customized workflows that exist outside formal documentation

- Internal team reliance on informal communication channels

As these elements accumulate, the 3PL logistics relationship becomes structurally embedded in daily operations. Even when performance declines, change feels risky.

This is why many companies describe a pattern of “outgrowing” their third party logistics provider without being able to exit cleanly. The operation still functions, but flexibility diminishes.

Dependency risk is not inherently negative. In some cases, it reflects deep integration and efficiency. The problem arises when dependency is unintentional and unmanaged.

Hidden risks in 3PL logistics rarely announce themselves early. They develop quietly, through limited transparency, weak feedback loops, and growing operational dependency. Understanding these risks is essential before evaluating providers—or before concluding that a current arrangement is “good enough.”

Pillar 3: Why Most Companies Choose the Wrong 3PL Partner

Most failed 3PL logistics relationships do not fail because the provider lacks capability. They fail because the selection criteria were misaligned from the start. In many cases, the wrong decision feels reasonable at the time of signing and only reveals its limitations once operations are underway.

The patterns below are consistently observed across different industries, order profiles, and growth stages.

Optimizing for Price Instead of Control

The most common mistake in selecting a 3PL logistics provider is treating price as a proxy for efficiency. Lower rates are often interpreted as better operations, when in reality they usually reflect a different allocation of control.

Pricing models that appear simple and competitive often assume:

- Standardized workflows

- Limited exception handling

- Minimal customization

- Client-side responsibility for coordination

When these assumptions hold, costs remain stable. When they do not, control shifts away from the client, and costs reappear in less visible forms—delays, manual intervention, or constrained decision-making.

In practice, many companies realize too late that they did not purchase lower cost; they accepted lower control.

Confusing Provider Size With Fit

Another frequent error is assuming that larger or more established providers are inherently safer choices. While scale can bring process maturity and infrastructure, it also introduces rigidity.

Large third party logistics providers often optimize for volume consistency and standardized operations. This works well for businesses that fit their model but creates friction for those with:

- Irregular order patterns

- High SKU complexity

- Frequent operational exceptions

At HUIXIN, we often see clients arrive after working with capable, well-known providers that were simply mismatched to their operating realities. The issue was not competence, but fit.

A “leading” 3PL is not universally suitable. Capability without alignment still produces inefficiency.

For a deeper breakdown of how different provider models create different trade-offs, see:

Leading 3PL Providers Explained: Models, Capabilities, and Trade-offs.

Overlooking Operational Transparency

Many selection processes focus on service scope—what a 3PL logistics provider claims it can do—rather than how outcomes are generated and measured.

Operational transparency is rarely tested during evaluation. Questions such as:

- How exceptions are logged and reviewed

- How inventory discrepancies are investigated

- How performance data is validated

are often deferred until after onboarding.

When transparency is weak, clients are forced to accept explanations instead of evidence. Over time, this shifts the relationship from managed partnership to trust-based dependency, which limits corrective action.

Ignoring the Learning Curve Cost

Every 3PL logistics relationship includes a learning curve. Processes need to be aligned, data flows stabilized, and teams trained to communicate effectively. The mistake is assuming this cost is temporary or negligible.

In reality, the learning curve has both direct and indirect costs:

- Internal team time spent on coordination

- Temporary performance degradation

- Delayed decision-making during adjustment periods

When switching 3PL logistics providers, these costs repeat. Companies that underestimate them often remain in suboptimal arrangements simply to avoid restarting the process.

The wrong choice is not always the provider with the weakest execution—it is often the one that creates the highest friction to change.

Choosing the wrong 3PL logistics partner is rarely about poor intentions or obvious red flags. It is about decisions made with incomplete evaluation criteria, where price, reputation, or convenience outweighed structural fit and long-term control.

This is why a deliberate decision framework is necessary—not to eliminate risk, but to ensure that risks are visible, intentional, and manageable from the beginning.

Pillar 4: A Practical Decision Framework to Select the Right 3PL Partner

After understanding cost behavior, hidden risks, and common selection mistakes, the remaining question is not which 3PL is best, but which 3PL model is manageable for your business. A usable decision framework does not eliminate uncertainty; it defines boundaries so that uncertainty stays within acceptable limits.

In 3PL logistics, the goal of a framework is control—not optimization.

Step 1: Define Your Control Boundaries

Before engaging with any 3PL logistics provider, companies need to be explicit about which decisions they are willing to outsource and which must remain internal. This step is often skipped because it feels abstract, but it determines whether a future partnership will remain workable.

Key areas to clarify include:

- How much operational autonomy the provider has during exceptions

- Whether inventory decisions can be made without client approval

- What level of data latency is acceptable

- Which KPIs are informational versus enforceable

From our experience at HUIXIN, most downstream conflicts originate not from disagreement, but from unspoken assumptions about control. Once boundaries are defined, provider conversations become more concrete and less sales-driven.

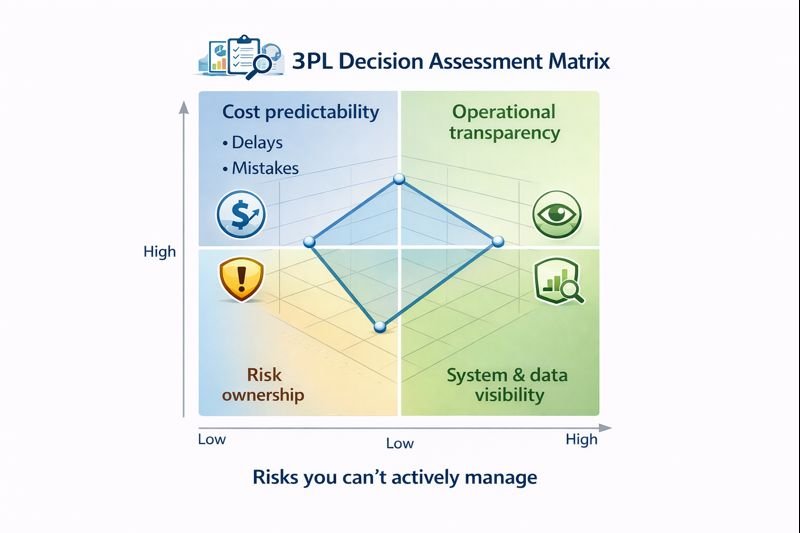

Step 2: Evaluate 3PL Providers Across Four Dimensions

Rather than comparing 3PL logistics services feature by feature, providers should be evaluated across a small set of structural dimensions. These dimensions determine how the operation behaves under pressure.

Cost predictability

Not whether pricing is low, but whether it remains stable as volume, seasonality, and complexity change.

Operational transparency

The ability to trace outcomes back to processes and decisions, especially when results deviate from expectations.

System and data visibility

Access to timely, decision-grade data rather than retrospective summaries.

Risk ownership

Clarity on who identifies, manages, and absorbs operational risk when exceptions occur.

This type of evaluation often reveals meaningful differences between providers that appear similar on paper.

Step 3: Stress-Test Before You Commit

The final step in selecting a third party logistics partner is validation under realistic conditions. Paper evaluations and references are useful, but they cannot substitute for operational exposure.

Effective stress-testing may include:

- Running a limited-volume pilot

- Simulating peak or exception-heavy scenarios

- Reviewing sample billing and reconciliation workflows

- Testing response time and escalation paths

Stress-testing does not guarantee future performance, but it reduces the likelihood of structural surprises after full onboarding.

A 3PL logistics decision is rarely reversible without cost. This framework is not designed to maximize short-term efficiency, but to ensure that the chosen partnership remains controllable as the business evolves.

When applied consistently, it shifts the selection process from vendor comparison to operating model alignment—where long-term outcomes are decided.

If you want a deeper look at real-world lessons that only become visible after implementation, see:

Top 3PLs & Logistics Insights: What Experienced Sellers Learn Over Time.

Frequently Asked Questions About 3PL Logistics

What is the difference between 3PL logistics and traditional logistics services?

3PL logistics goes beyond executing isolated tasks like transportation or warehousing. A third party logistics provider typically takes responsibility for day-to-day fulfillment operations, process execution, and system-driven decisions. Traditional logistics services usually remain transactional, while a 3PL relationship reshapes how operations are run.

How do I know if my business actually needs a 3PL?

A 3PL logistics model makes sense when fulfillment execution is operationally complex but not strategically differentiating. If your team spends disproportionate time managing warehouse labor, peak-season volatility, or multi-channel fulfillment, a 3PL can create leverage. If fulfillment decisions are tightly coupled with your core value proposition, outsourcing may introduce more risk than benefit.

Why do 3PL costs often increase after onboarding?

Initial 3PL pricing usually reflects standardized scenarios. As real-world conditions emerge—returns, slow-moving SKUs, order spikes, or exceptions—costs surface through operational friction rather than explicit fees. This is why cost predictability matters more than headline pricing when evaluating 3PL logistics services.

Is a local 3PL always better than a remote one?

Not necessarily. A local 3PL logistics provider can reduce transit time or improve communication, but proximity does not guarantee operational fit. For some business models, local fulfillment adds unnecessary cost or complexity. The decision should be driven by order profiles, exception frequency, and data requirements—not distance alone.

How hard is it to switch 3PL providers?

Switching 3PL logistics providers is often more difficult than expected. Beyond physical inventory movement, switching involves process knowledge, system data, internal retraining, and temporary performance risk. This is why dependency risk should be evaluated before—not after—committing to a long-term partnership.

What should I prioritize more: cost, service level, or control?

In practice, these three are interdependent. Lower cost often comes with reduced control; higher service levels may require tighter operational alignment. The most sustainable 3PL logistics decisions prioritize control and predictability, allowing cost and service quality to remain manageable over time.

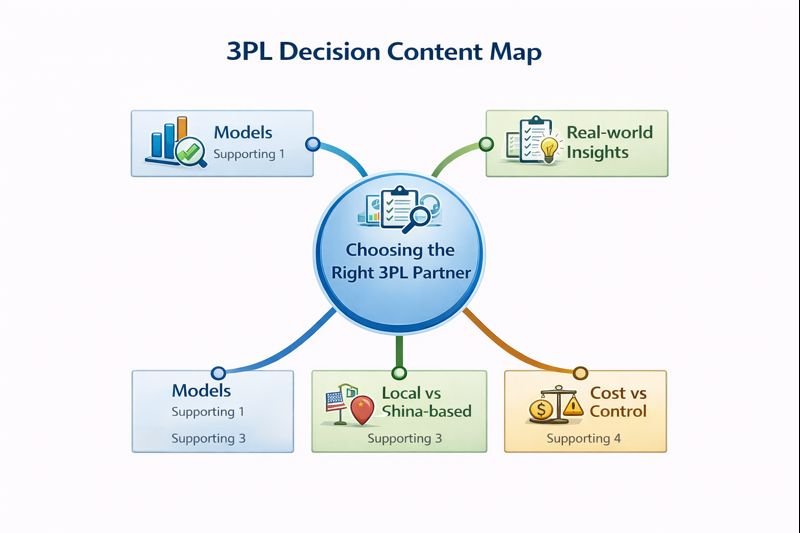

Closing: How to Use This Pillar — and Where to Go Next

Choosing the right 3PL logistics partner is not about finding the “best” provider in the market. It is about selecting an operating model that aligns with your business realities, risk tolerance, and control requirements.

This Pillar page is designed to provide the full decision logic: how costs behave, where risks hide, why selection mistakes repeat, and how to evaluate providers systematically. However, different readers enter the decision process at different stages. That is where the Supporting articles come in.

If you are still trying to understand how different 3PL providers actually operate, and why similar-looking companies produce very different outcomes, start with:

Leading 3PL Providers Explained: Models, Capabilities, and Trade-offs

If you want to learn from patterns that only emerge after real usage, including common surprises and long-term lessons experienced sellers report, continue with:

Top 3PLs & Logistics Insights: What Experienced Sellers Learn Over Time

If you are considering a local 3PL fulfillment service and want to understand when location truly matters—and when it does not—read:

How to Find Local 3PL Fulfillment Services (and When You Actually Need One)

If your core concern is whether outsourcing logistics is worth the cost compared to keeping control in-house, explore:

Is 3PL Logistics Worth the Cost? A Practical Cost vs Control Analysis

Together, these pages are intended to support deliberate, informed decisions—whether you ultimately choose to work with a 3PL, delay outsourcing, or redesign your current setup. In 3PL logistics, the most costly mistake is not choosing the wrong provider; it is choosing without understanding what you are committing to.