Why “Top 3PLs” Rarely Look Obvious at the Beginning

If you are searching for top 3PLs, chances are you are still in the comparison stage.

If you have already worked with a logistics partner, you probably no longer trust that phrase in the same way.

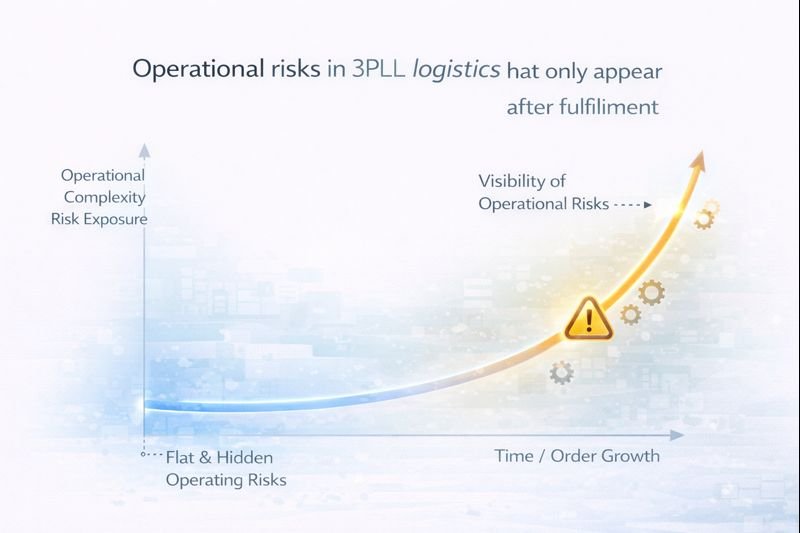

From our position as a China-based 3PL, what we see most often is this: the most useful

3PL logistics insights only become clear after real operations begin.

Before onboarding, most providers look similar on paper. Service lists overlap, warehouse photos look reassuring,

and process diagrams sound reasonable. In practice, the differences that matter show up only when orders start flowing,

product data stops being perfect, and volume changes in ways no forecast fully predicted.

That is why experienced sellers evaluate partners less by claims and more by what becomes visible under pressure.

If you want the decision framework behind this, start with our main guide:

Choosing a 3PL Partner

.

This page is designed as a supporting read—something you come back to when you want to sanity-check what you are seeing in day-to-day operations.

How Experienced Sellers Change What They Pay Attention To

When sellers first compare a 3PL, they naturally focus on visible factors: quoted rates, warehouse size, location,

and service coverage. Over time, those signals lose power. The sellers who have been through real fulfillment cycles

start caring less about what looks impressive and more about whether the operation feels stable.

A low rate per order stops being attractive if fulfillment constantly pulls attention away from the business.

If you are currently weighing providers, it helps to ask a different kind of question:

will this partner reduce your operational noise—or increase it?

That question is closely tied to cost in ways pricing tables do not capture, which is why we break down real-world cost drivers here:

3PL Logistics Cost.

If you are shipping from China and your model requires speed and control at the same time, the fulfillment setup matters just as much as the provider.

That is also why many sellers end up revisiting local distribution strategies later:

Local 3PL Fulfillment.

What Real Orders Reveal That Sales Calls Never Do

Once operations go live, sellers begin to notice patterns that rarely come up during onboarding.

They notice whether issues are discovered internally or only after customers complain.

They notice whether communication is proactive or reactive, and whether explanations lead to operational adjustments

or simply become repeated conversations.

If you are currently in the first month of a new 3PL relationship, pay attention to how quickly the operation becomes quieter.

Quiet does not mean “no problems.” It means problems do not keep reappearing in new forms.

From our side at Huixin, we have learned that trust is built less by reassurance and more by consistency—

the kind you only see when orders arrive every day.

Why Many “Top 3PLs” Become Constraints as Sellers Scale

One of the most common insights we hear from experienced sellers is that early satisfaction does not guarantee long-term fit.

A setup that feels smooth at low volume can become fragile as your business expands across channels,

introduces new SKUs, or runs promotions that change order patterns.

If you are scaling, the question is no longer whether your 3PL can ship.

It becomes whether the operation can adapt without turning every change into friction.

This is also where the difference between “a provider that can do many things” and “a provider that can do them consistently”

becomes obvious.

If you are browsing lists of top 3PLs, use them as a starting point—not a conclusion.

Rankings are useful only when you interpret them through operational reality.

We keep a separate page for that context here:

Leading 3PL Providers.

How Sellers Reframe the 3PL Decision Over Time

With experience, the decision shifts from “Which 3PL should I choose?” to “How do I know when my logistics setup no longer fits?”

Sellers start reflecting on how much internal bandwidth fulfillment consumes, how predictable outcomes feel,

and how difficult it is to adjust processes when the business changes direction.

If you are currently uncertain whether you should stay or switch, it helps to treat the choice as reversible.

In our conversations, delayed switching is often driven less by satisfaction and more by fear of disruption.

Yet in hindsight, many sellers discover that staying too long created more disruption than an earlier transition would have.

The broader decision logic is covered in the main framework:

Choosing a 3PL Partner.

Using These 3PL Logistics Insights Before You Commit

If you are evaluating providers today, the most practical move is not collecting more feature lists.

It is learning how to interpret operational behavior once real orders start flowing.

The most useful 3PL logistics insights come from what happens after the first set of shipments,

not what is promised before them.

If you are already working with a partner, you can also use this page as a reference point:

3PL Logistics Insights.

A well-run operation should become less noticeable over time—not more.

If you are trying to decide what “good” looks like for your current stage, or you want to pressure-test fit before you commit long-term,

you can reach us here:

Contact Us.

At Huixin, we typically start by mapping your order patterns and exception scenarios first, then working backward into processes and cost structure—

because that is where long-term outcomes are usually decided.